在瞬息万变的后疫情时代,各种传统行业的数字化转型持续迅猛发展。传统上进展缓慢的行业(例如人寿保险)是一个很好的例子,科技初创公司时下正在利用创新方式解决众所周知的诸如客户体验不佳的老问题。

In the ever-changing post-pandemic world, the digital transformation of various legacy industries continues to evolve at a faster pace. Traditionally slow-moving industries such as life insurance make for fascinating examples, where technology startups are tackling well known and age-old problems, such as poor customer experience, in innovative ways.

在瞬息万变的后疫情时代,各种传统行业的数字化转型持续迅猛发展。传统上进展缓慢的行业(例如人寿保险)是一个很好的例子,科技初创公司时下正在利用创新方式解决众所周知的诸如客户体验不佳的老问题。

To find out more about what’s happening within the life insurtech industry, we spoke with Nelson Lee, the founder of iLife Technologies, a B2B insurtech SaaS (Software-as-a-Service) startup whose product allows life insurance brokers to build interactive client experiences that involve zero coding. The company launched its product in mid-2021 and has over 1000 insurance brokers as users after four short months.

为了了解更多关于寿险科技行业的情况,笔者采访了iLife Technologies的创始人Nelson Lee。iLife Technologies是一家B2B保险科技SaaS(软件即服务)创业公司,寿险经纪人iLife Technologies旗下的产品可以建立零编码的互动客户体验。该公司在2021年中推出自己的产品,在短短四个月后就发展了超过1000名保险经纪人用户。

**Gary Drenik: What trends have you noticed around life insurance during and post pandemic? Are more people buying life insurance these days?**

Gary Drenik(笔者):在大流行和后大流行期间,你有没有注意到人寿保险一些趋势?现在更多的人购买人寿保险吗?

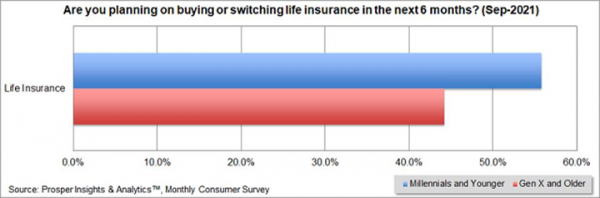

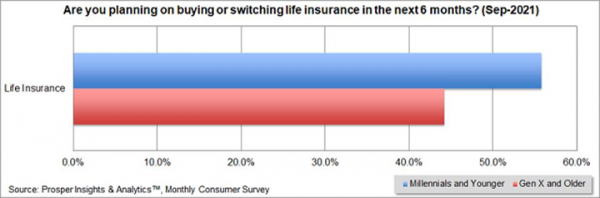

**Nelson Lee:** Life insurance as a financial product has definitely been trending upwards in awareness. A recent Prosper Insights & Analytics survey shows that on average 8.6% of adults in the US indicate they are considering buying or switching a life insurance policy in the next 6 months, with over half of that group being millennials or younger, debunking that stereotype that life insurance buyers are typically seniors.

Lee:人寿保险金融产品的认知度肯定有上升的趋势。最近的Prosper Insights & Analytics调研显示,美国平均8.6%的成年人表示他们考虑在未来6个月内购买或更换人寿保单,其中一半以上是千禧一代或更年轻的人,这一点推翻了人寿保险买家通常是老年人的论调。

img_

Prosper - Buying or Switching Life Insurance Prosper Insights & Analytics

Prosper:未来6个月内计划购买或更换人寿保单 (图:Prosper洞察力和分析)

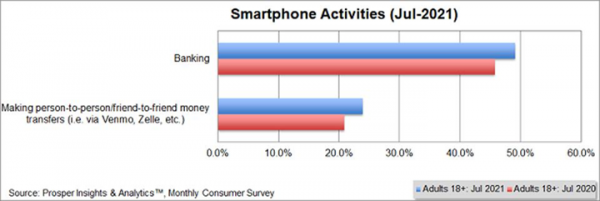

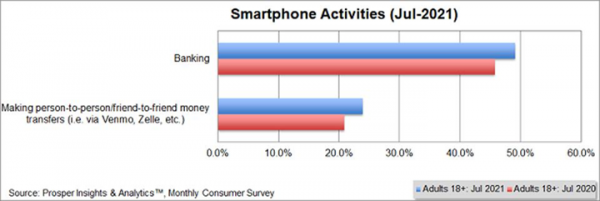

On a broader scope, fintech as an overall landscape is quickly expanding, with over 49.1% of smartphone users engaged in mobile banking, 23.9% making direct payments to another, both of which, according to Prosper Insights & Analytics, are up year over year. This indicates an overall accelerated migration towards digital experiences and transactions in the world of financial services, insurance included.

从更广泛的范围来看,金融科技的大格局正在迅速扩展,超过49.1%的智能手机用户处理过移动银行业务,23.9%的智能手机用户曾直接付款,根据Prosper洞察力与分析的数据,这两个数都在逐年上升。这表明,包括保险在内的金融服务领域的整体正在加速向数字体验和交易迁移。

img_

Prosper - Smartphone Activities Prosper Insights & Analytics

Prosper - 智能手机用于银行业务及支付(图:Prosper Insights & Analytics)

**Drenik: On-demand insurance options have been the norm for a while now in areas like auto and home, so why hasn’t the life insurance space been transformed yet?**

Drenik:在汽车和住宅等领域,按需保险选项已经成了常态,为什么人寿保险领域还没有变呢?

**Lee:** I think the answer to that really starts with the actual concept of “on-demand” itself, in that an on-demand offering is only feasible and valuable if it’s actively in demand without another human being involved in the transaction process.

Lee:我认为这个问题的答案其实起始于“按需”本身的实际概念,因为按需提供的服务只有在没有其他人参与交易过程的情况下才是可行的和有价值的。

Classic consumer on-demand makes the most sense when consumers are both well-educated on a simple product, as well as proactively looking for it.

只有当消费者对一个简单的产品有充分的了解并主动寻找这个产品的时候,经典的消费者按需服务才是最有意义的。

We see that Auto and Home are classic examples of consumers demanding products without necessarily needing context built by hu man professionals, the same way we want video content on demand, and therefore an on-demand offering there makes a lot of sense.

我们能看到汽车和住宅是消费者消费产品这方面的典型例子,这种场景下不一定需要专业人员建立的背景,和我们对视频内容的需求场景差不多一样,因此,这种情况下提供按需服务是非常有道理的。

In the life space, products are neither simple nor very well understood by the average consumer, and therefore the need and desire for a human expert to provide guidance essentially changes what on-demand really is in that vertical context.

而人寿领域的产品对于普通消费者来说就不是那么简单了,他们对相关的产品也不太了解,因此普通消费者需要也希望得到人类专家的指导,这种垂直背景基本上就改变按需服务的真正含义。

In life insurance, most consumers don’t wake up suddenly wanting a life policy, they slowly build awareness and contextual background on why a policy may financially make sense via a human professional such as a financial advisor or insurance agent, and therefore the demand generation comes from human context and interaction, not from spontaneous desires. This explains why despite all the D2C innovations going on in the P&C space with Home and Auto, over 95% of Life Insurance premiums are still distributed in some way via a human being.

大多数人寿保险消费者不会突然一天早上醒过来想要买一份人寿保险,他们一般都是通过财务顾问或保险代理人等人类专业人士的交流,慢慢地建立有关保单在财务上的意义等认识和相关的背景,因此,需求的产生来自人类背景和互动,而不是自发的需求。这也回答了你的问题,尽管在财产事故保险领域的房屋和汽车方面有很多D2C(直接面向消费者)创新,但超过95%的人寿保险的保费仍然通过某种人类方式完成的。

**Drenik: It seems like the vast majority of technology innovation in the insurance space has been in direct-to-consumer, so why is iLife keeping human brokers a part of the process?**

Drenik:似乎保险领域的绝大多数技术创新都是直接面向消费者类型的,那么为什么iLife要在这个过程保留人类经纪人这部分呢?

**Lee:** This is somewhat related to the earlier question regarding on-demand offerings. Life insurance as a product category is infinitely more complex compared to many other types of consumer-oriented insurance, and therefore human guidance will always be a key element in the consumer education and decision-making process. When we founded the company, it was always clear to us that the big problem to solve wasn’t how to replace millions of agents, but rather how to help them and their consumers both have easier times interacting with one another in a digital environment. We are a b2b SaaS company with the firm belief that there is more value to be created by helping other human beings rather than replacing them in this industry, and that’s both for the industry as a whole, as well for the consumer themselves. We’re very fortunate to have VC investors who are aligned and feel the same way, which is always helpful.

Lee:这个与之前有关按需提供服务这个问题有些关系。人寿保险这个产品类别与许多其他类型的面向消费者的保险相比要复杂好多,因此,人的指导在消费者教育和决策过程中将永远是一个关键因素。我们在创立iLife时,我们一直都十分清楚要解决的大问题不是如何取代数以百万计的代理人,而是如何帮助他们和他们的消费者在数字环境中更容易相互交流。我们是一家B2B型的SaaS公司,我们坚信在这个行业中可以通过帮助其他人类而不是取代他们而创造更多的价值,对于整个行业而言是这样,对于消费者而言也是。我们非常地幸运。因为我们的风险投资人也有相同感受,这总是很有帮助的。

**Drenik: How does iLife change life and business for brokers themselves?**

Drenik:iLife是如何改变经纪人本身的生活和业务的?

**Lee:** With remote work quickly on the rise in various industries, it was clear that whatever made remote work easier would also enhance the quality of life outside of work, and that to us was a huge problem in the industry that many have overlooked.

Lee:远程工作在各个行业迅速崛起,显然,任何能够令远程工作更容易的东西也可以提高工作以外的生活质量,对我们来说,这是行业中的一个巨大问题,而许多人都忽略了这个问题。

The technology we’ve built lets brokers run a successful business from anywhere at minimal cost, without requiring any coding knowledge or in-house tech personnel. This means more time with family, less money spent on unnecessary manual back-office processes, while consumers enjoy better digital experiences. A huge win-win for all parties involved.

我们打造的技术可以让经纪人在任何地方以最小的成本成功地经营业务,不需要任何编码知识或内部技术人员。这意味着他们有更多的时间与家人在一起,可以在不必要的手动后台程序上花更少的钱,而消费者则可以享受更好的数字体验。对所有参与方来说,这都是一个巨大的双赢。

Internally we say that everything we build should work right out of the box within 60 seconds. The product needs to be like a household appliance, plug it in and immediately working to deliver value.

我们在内部提出,我们建立的一切都应该能在60秒内开箱即用。产品需要像家用电器一样,插上电源就能立即工作和开始提供价值。

**Drenik: What's the future like for the life insurance industry, and what will agents and brokers of the future look like?**

Drenik:人寿保险业的未来是什么样子、未来的代理人和经纪人会是什么样子呢?

**Lee:** I think we will continue to see fast emerging group of tech-savvy players that clearly sees the digital age as the present and makes significant investments early on to realize the gains sooner than later. RTB Financial Group, an iLife customer, is a great example of this type of tech-enabled digital broker. They offer functionalities powered by our technology to support their agents’ success remotely from anywhere, and as a result they have an edge not only in client experience, but also in recruiting, because for agents it’s simply better, easier, and happier to be working for an agency that helps them succeed from anywhere, as opposed to traditional agencies that have very little meaningful technology infrastructure in place, and still mostly rely on manual processes.

Lee:我认为我们会不断看到快速崛起的一批精通技术的参与者,他们能清楚地看到数字时代的到来,他们会在早期进行大量的投资以期尽早实现收益。iLife的客户RTB金融集团就是这种科技型数字经纪商的典范。他们提供经由我们的技术驱动的功能,为他们的经纪人提供支持,令他们可以在任何地方都获得成功,因此,他们不仅在客户体验方面有优势,而且在招聘方面也有优势,因为对于经纪人来说,能够成为一个能够帮助他们在任何地方获得成功的机构的经纪人一定是件好事、容易的事以及快乐的事,而与之相比,传统机构没什么技术基础架构,而且仍然主要依赖人工流程。

On the industry level, digitally savvy carriers and brokerages will continue to attract tech savvy brokers, who will then in turn attract tech savvy consumers, all of which are fast growing categories. Legacy players will continue to retain brokers who insist changes are not needed, and the two different types of brokers will continue to look more different with each passing technology cycle, and consumers will end up with many more options than they use to have in terms of experiences.

在行业层面上,精通数字技术的承办商和经纪商可以持续吸引精通技术的经纪人,而这些经纪人又会吸引精通技术的消费者,所有这些都是快速增长的类别。那些坚持不需要改变的经纪人则会滞留在传统企业,随着每个技术周期的完结,两种不同类型的经纪人也会变得更加不同,而消费者最终将在体验方面拥有比以往更多的选择。

**Drenik: Thank you, Nelson, for sharing insights about the life insurance space with us. Hopefully, consumers can all begin to enjoy better digital experiences in the industry no matter where they buy from soon enough.**

Drenik:谢谢你与我们分享关于人寿保险领域的见解。希望消费者无论从哪里购买人寿保险都能很快开始享受更好的行业数字体验。